Mirae Asset Securities pursues sustainable management, as “We are committed to pioneering a sustainable future through investment and asset management” as articulated in our ESG management mission.

Overview of

ESG Policy

Frameworkework

We aim to build and fulfill sustainable environment within our company-wide business activities. To this end, Mirae Asset Securities has set out ESG management principles and medium/long-term strategies that are consistent with global ESG standards.

- Mirae Asset Securities engages in diverse business activities based on the management philosophy, core values, and investment principles of Mirae Asset Financial Group. Through the global allocation of high-quality assets and robust risk management, Mirae Asset Securities is committed to empowering clients and society to create greater wealth and prepare for a comfortable future.

- Recognizing the importance of actions that contribute to the achievement of the UN Sustainable Development Goals (UN SDGs), Mirae Asset Securities actively discloses its sustainable finance performance by business segment. Having identified shared growth as a strategic goal early on, Mirae Asset Securities has focused on creating a sustainable future through ESG investments and management, providing growth funding solutions to new growth companies, venture capitals, and innovative SMEs.

- In collaboration with the Mirae Asset Park Hyeon Joo Foundation, Mirae Asset Securities offers scholarship and philanthropic programs. Mirae Asset Securities also seeks to close the gap in financial literacy by bringing financial education to underserved communities, including through sisterhood ties with K-12 institutions (elementary, junior high, and high schools). To promote inclusive capitalism and shared growth with local communities, Mirae Asset Securities encourages employee participation in volunteer activities that align with the corporate culture of sharing. In addition, as an owner of professional table tennis teams, Mirae Asset Securities promotes broader public participation in sports.

- As the first company in the Korean financial sector to join the global RE100 initiative, Mirae Asset Securities plans to shift to 100 percent renewable energy by 2025, thus demonstrating its commitment to more sustainable operations and the successful transition to a low-carbon economy. By taking preemptive action to address climate change and supporting stakeholders’ efforts to achieve carbon neutrality, Mirae Asset Securities endeavors to take a leading role in the renewable energy finance market.

- Through the ESG policy framework, Mirae Asset Securities has set a sustainable finance goal for 2025 and a medium/long-term strategic direction for the environment, society, and governance. Mirae Asset Securities will faithfully carry out its role in creating greater value for diverse stakeholders and helping to bring about a more sustainable future for society.

ESG Principles for Responsible Investment (PRI)

Mirae Asset Securities is committed to integrating Mirae Asset Financial Group’s investment principles1) and the following ESG Principles for Responsible Investment (PRI) into the entire decision-making process in which we engage in through investment and asset management.

-

Principle 1

Mirae Asset Securities will incorporate ESG issues into investment and its decision-making process.

-

Principle 2

Mirae Asset Securities, as a professional investment body, will faithfully undertake its role in realizing a healthy society through active engagement.

-

Principle 3

Mirae Asset Securities will proactively seek appropriate ESG disclosures by the entities in which we invest.

-

Principle 4

Mirae Asset Securities will work to promote acceptance and implementation of the Principles within the financial industry and the capital markets.

-

Principle 5

Mirae Asset Securities will continue to collaborate with stakeholders to ensure the efficient implementation of the Principles.

-

Principle 6

Mirae Asset Securities will proactively disclose our ESG-related information and progress towards the implementation of the Principles.

1) Mirae Asset Financial Group’s investment principles are as follows:

1. Mirae Asset identifies sustainable competitiveness of companies.

2. Mirae Asset invests with a long-term perspective.

3. Mirae Asset assesses investment risks with expected return.

4. Mirae Asset values a team-based approach in decision making.

Medium/Long-Term

Strategies for ESG Management

Mirae Asset Securities has set a goal to deliver KRW 45 trillion in sustainable finance by 2025. To this end, we will focus on three key areas based on our strategic priorities, fulfilling our role as a global investment company that is committed to carrying out business in a socially conscious way to help realize a sustainable future.

-

ESG Management Mission

We are committed to pioneering a sustainable future through investment and asset management.

-

2025 Goal

Reach KRW45 trillion in sustainable finance2)

-

Focus Areas & Strategic Priorities

-

Governance & Accountability

- Foster more accountable/ethical management

- Enhance management transparency

- Enhance risk management & identify opportunities

-

Climate Engagement

- Expand green and low-carbon finance

- Convert to renewable energy

- Manage carbon emissions from investment assets

-

Inclusive Growth

- Expand inclusive finance

- Improve access to financial services

- Expand ESG campaigns

2) 2020 baseline applied; ESG investment, advisory, and underwriting services (cumulative sum), ESG-themed bonds and WM products (outstanding balance)

-

Governance & Accountability

Three core areas for ESG management

ESG Governance

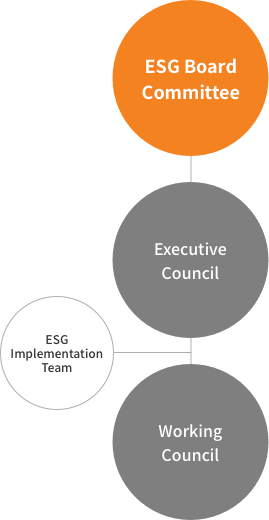

We have established a four-level governance system to integrate ESG management into our operations, engaging in decision making on ESG policies, strategies, and risk management with an eye toward having a positive impact across the ESG spectrum.

- ESG Board Committee

- Executive Committee

- Working Committee

- ESG Implementation Team

- ESG Board Committee

- - Oversees and monitor company-wide ESG policies and medium/long-term ESG strategies

- Executive Committee

- - Discuss company-wide ESG policies and medium/long-term ESG strategies. - Review progress and issues related to ESG strategic tasks

- Working Committee

- - Led by ESG Implementation Team, Working Committee actively engage with Executive Committee regarding overall ESG tasks